2025 Q1 Market Commentary

Not being a natural writer, more of a talker, these commentaries are never easy to write, but the level of difficulty varies depending on the major stories shaping the financial world. I will let you decide where the current situation falls on the spectrum of “easy” to “how do I even start this?”

In these commentaries, I have always tried to stay apolitical, which is no small feat. That will not change with this writing, but much of what has shaped recent financial news has been greatly, if not entirely, based on decisions from the new administration. I will attempt to articulate what is going on, the motivation behind it, and the possible outcomes.

As of now, there appear to be a few key players in the new Trump administration:

- Elon Musk, CEO of Tesla, SpaceX, and X, who oversees the Department of Government Efficiency (DOGE).

- Scott Bessent, Secretary of the Treasury.

- Howard Lutnick, Secretary of Commerce.

This is not to say that only these three and Trump are setting policy, but they appear to be the most visible mouthpieces of the efforts.

The economic agenda centers around a 3-3-3 plan as laid out by Treasury Secretary Bessent. In simple terms, 3-3-3 refers to:

- Decreasing budget deficits to 3% of Gross Domestic Product (GDP) by 2028, Trump’s final year in office (currently at 6.4%). This is to be accomplished by better controls of wasteful government spending and cutting off what they feel is unnecessary government bureaucracy.

- Upping GDP to 3% through deregulation and promoting pro-growth policies.

- Increasing U.S. energy production to an additional three million barrels of oil per day.

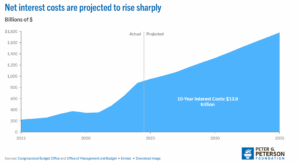

I think it is important to articulate why the administration believes dramatic changes are needed. Put simply, they believe the current economic path of the United States is unsustainable. The current debt of the United States is $36 trillion.[1] Yes, trillion with a “t.” In 2024, the percentage of the budget going toward paying interest on the debt was 13%.[2] That is a problem that is only expected to worsen as interest rates remain high and the debt grows.

Chart from “What Is the National Debt Costing Us?” by Peter G. Peterson Foundation, 2025.

I believe both political parties understand that the debt levels are an issue that needs to be dealt with but have different approaches to solving it. I am not advocating for or against the current plan but providing context for the desire for dramatic change.

I will contend that for now, the administration, or at least, the media has focused primarily on the first three in the plan: getting the deficit to 3% of GDP. One aspect of this is DOGE and its attempt to cut government waste, including fraud, overspending and unnecessary employees. The results are mixed so far, and it is too early to make a clear determination on how successful these cuts will be.

Recently, the primary strategy to close the deficit is raising revenue through tariffs. The fact that this administration is proposing tariffs should not come as a surprise. Trump has long been a proponent of tariffs and made it a central theme of his candidacy. The tariffs announced by Trump on April 2 shocked almost everyone. An initial tariff of 10% was levied on countries across the board, with specific countries facing very high reciprocal tariffs based on… well, that is not entirely clear. It was said to be based on unfair trade practices, but it appears to be driven more specifically by their goods trade deficit with the United States.

After the initial announcement, it feels like there have been daily or even hourly updates on postponements and tariff deals that further muddy the waters. The stock and bond markets have made it clear that they are not in favor of tariffs, nor are they in favor of the uncertainty surrounding their size or implementation. As of now, it is believed that the administration wants to make deals to lower the tariffs but still potentially maintain a floor of 10%. Clearly, all this is dependent on the administration cutting deals and getting away from the currently proposed extremely high tariffs, which would have dramatic and detrimental effects on the economy and markets. The most important, and likely most difficult, discussions will likely be with China. As these discussions are very fluid, I will refrain from getting into details until we have more clarity.

To restate my earlier position, this is neither a critique nor an endorsement of current policy but a review of what is happening. One point we are sure of and that has been highlighted since January 2025 is that diversification is as important as ever for long-term investors. As of this writing, the S&P 500 is down around 10.18%, while the MSCI EAFE (a common benchmark for all non-U.S.-based stocks) is up around 7.25%. Additionally, core fixed income or bonds are up around 1.5% for the year. Therefore, a diversified portfolio has seen less of a pullback than a portfolio invested primarily in U.S stocks. I read a quote recently from a fellow advisor where the client said, “finally, the bonds in my portfolio are serving a purpose.” In reality, the bonds have always served a purpose – the client just did not realize it until now.

We will continue to monitor the moves of the administration and how their policies affect the markets, and we stand ready to make shifts in investment strategy as needed. However, diversification, along with detailed planning and personal cash flow analysis, is a cornerstone of how we manage assets. That has been the case for years and will continue to be a focal point.

This commentary could easily be 10 pages, but I already said I am more of a talker than a writer, so I will cut it off here. If you wish to discuss anything mentioned above or delve into your specific situation, please reach out to us. We look forward to hearing from you.

– Will Bowen

The views and opinions expressed are of Persium Advisors, LLC. This commentary is provided for educational purposes only and should not be construed as investment advice. Persium Advisors is an investment advisor firm located in Atlanta, GA.

[1] https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

[2] https://econofact.org/the-rising-burden-of-u-s-government-debt

ph 678.322.3000 / fax 678.322.3059

Persium Group, LLC / 2100 Riveredge Parkway, Suite 1230 / Atlanta, GA 30328

Persium Group consists of three teams: Persium Advisors — wealth management for business owners and other investors, NAVIX — exit planning for business owners, and CoVerity — serving the needs of retirement plan committees.

The Persium Group, formerly known as White Horse, is an independently owned and operated firm that was founded in 2004. In 2010, White Horse Advisors, LLC registered with the Securities and Exchange Commission as an investment adviser allowing us to operate in a product neutral, fee-only investment environment.